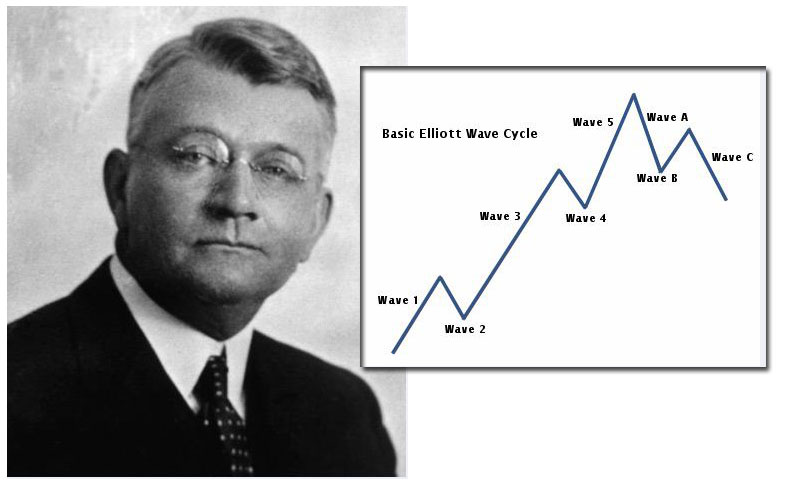

About the Author Ralph Nelson Elliott

Ralph Nelson Elliott came into the world in 1871 and began to make a major earth-shaking contribution to it around the time he reached his 50’s. It was at that time that he contracted a disease while working in Central America and was forced to retire from active work. Ralph was a true scholar at heart, and he needed something to occupy his mind while he experienced bed rest and made an agonizingly slow recovery. While he was enduring physically mandated bed rest, this is when he had his epiphany on the way that stock markets (and eventually the entire universe) worked. He came up with his world-altering theory of stock market and general world behavior, which he compiled into a book that was published in 1938, entitled, The Wave Principle. The world has never seemed the same since the arrival of his first great book.

Review of The Wave Principle by Ralph Nelson Elliott

Elliott covers his fascinating and eerily true theories of all kinds of investment and stock market behaviors in this The Wave Principle, his first book on the subject. He did not set out to create a typical “get rich quick” scheme with this work, but rather to teach people ways in which the real world, including the investment markets, actually worked and practically functioned. In this respect, he was a scholar and not a guru. In the intervening years since he wrote these critical books and explanatory articles and then died, his Elliott Wave Principle has made a tremendous impact on a relatively small cadre of investors who learned more than simply the capability of recognizing this theory of incredible and practical value. More importantly, they learned the means of appreciating the subtle beauty of mankind’s experience in its abstract forms. His Wave Principle is far larger than simply an effective means of exploring movements in the stock and investment markets. It has also captivated mathematicians, philosophers, theologians, financiers, and psychologists since it exploded from his both creative and scientific mind and onto the mainstream of culture and modern thought.

Elliott discovered an entire theory of fractals decades before these became identified and then classified by modern-day Chaos Theory. What’s more, he not only uncovered them for the first time ever, he also detailed them wonderfully in a complete market behavior explanation. The book holds the secrets to market behavior for which have you been longing and searching. Do not misunderstand, the theory is not basic level study for any high school level individual. It requires serious personal application, deep devotion, and practical study to effectively grasp this complex theory of why and how the markets move up and down. More than this, the theory and utilizing it will require that you identify and escape from your personal emotional reactions which are both pre-programmed and inherent at the same time. The good news is that with sincere efforts and original thought and analysis of Elliott’s theory, you have in this book the tools that you require to make the quantum leap to the enviable level of most successful of traders.

There are many who would advise you, as do we too, to not spend any of your valuable time reading interpretations of the original master work on the Elliott Wave Theory until you have first gone through Ralph Nelson Elliott’s original masterpiece and primer on the subject. It is true that the subsequent expounder on the Elliott Wave Theory, Robert Prechter, provides capable and competent analysis and adds some interesting anecdotal insights into these waves and their anthropomorphic personalities, but he is still a learned disciple of the master, and not the master himself.

Robert R. Prechter, Jr. – Greatest Disciple of Elliott’s Wave Theory

Some readers of this book might be disappointed that the charts found in this over 70 year old work are the same ones that Elliott originally compiled and included in his pre-World War II published book, especially those from the 1930’s era of the Great Depression. It would be easy to complain that these charts have little to no bearing on the stock markets of today. This is simply not the case. Among the greatest problems with timing the markets is foretelling a bear market trend, in particular a shorter time frame one. This book and its charts help you to overcome this age-old problem in assisting you to properly analyze longer time frame bear market trends in the situations, moments, and scenarios where counting waves is absolutely critical.

This original masterpiece has helped the timing of countless market technicians immeasurably, especially assisting them with avoiding false bottoms in markets and in comprehending when market tops are in already. Elliott is in his greatest element when he sticks with the markets and how to analyze trends. The charts that he originally included are actually so useful that they will help out any person with a solid education and decent visual skills to evolve into a far better trader through fully comprehending them.

Review of Nature’s Laws: The Secret of the Universe by Ralph Nelson Elliott

While Elliott’s The Wave Principle is the original explanation of this genius’ economist and accountant’s master work which bears his own name, the nearly decade later published Nature’s Laws: The Secret of the Universe is his final magnum opus after his theory had become fully grown and more perfectly evolved. Published in 1946, a mere two years before his own death, Ralph Nelson Elliott’s final great work on the Wave Theory has been called everything from one of the greatest explanations of how the universe ultimately works and markets function in the real world to the delusional and wildly imaginative ramblings of a crazed old man. Despite this colorful array of reviews on the book, Nature’s Laws remains the grat definitive and conclusive work on the subject of The Elliott Wave Theory and Principle by the man who entirely conceived it.

Ralph Elliott fully developed his self-named theory throughout the 1930’s and 1940’s. This analytical tool is extremely potent and effective at predicting the behavior of stock markets. In this book, readers learn the basic concepts underlying Elliott’s Wave Principle, that the stock market prices both rise and declines in patterns which can be understood, and furthermore that such patterns can be coherently linked up together into these waves. While not everyone in the world has signed on to or ascribed to Elliott’s prescient theories for market mechanics, this his classic guide to the Principle has attained a literal cult-like status and impressive following among a fairly large and growing group of technicians and analysts in numerous countries around the globe.

For any individual who professes to have an interest in technical analysis or the analysis of waves more specifically, this book should be considered to be required reading. Without a doubt it is the definitive and ultimate work on Elliott’s scientific wave theory on human experiences. This Nature’s Law: The Secret of the Universe proves to be such a critical, engrossing, and even mind-expanding book that any and all serious students of the stock markets should read it at least once, whether they follow the schools of fundamental or technical analysis and whether they trade in stocks, commodities, or bonds. At only 121 pages in length, the book is subdivided into 27 chapters with a conclusion and introduction as well. These nice, shorter chapters make for an easy read that you can easily tackle in only a couple of sittings.

- Using Counting Fractals to Find Elliott Waves - May 19, 2016

- The Grand Supercycle Controversy - May 19, 2016

- Robert Prechter’s Enduring Impact on Elliott Wave Theory - May 12, 2016

- Elliott Wave Gold Review - April 29, 2016

- Common Objections to Elliott Wave Theory - April 28, 2016

- What Are Elliott Wave Theory’s Waves Within Waves About? - March 8, 2016

- Review of the New Classic Among The Elliott Wave Theory Books, “The Elliott Wave Principle” - February 25, 2016

- Reviews of 2 Classic Elliott Wave Theory Books - February 25, 2016

- The Origins of Elliott Wave Theory and How it Was Discovered - February 13, 2016

- Elliott Wave Stock Market Review - February 5, 2016