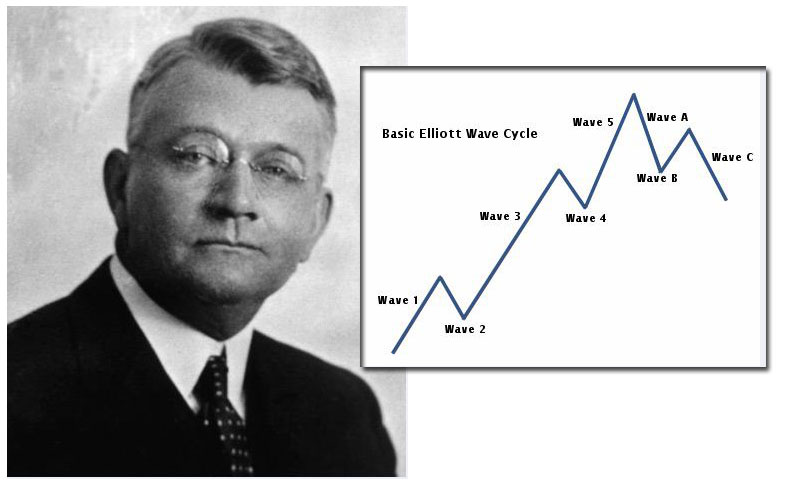

If you are a follower of Elliot wave theory, then you are familiar with how successful that form of technical analysis can be when it comes to predicting the price of stocks and stock indices. However, the stock market is just one financial market out of many. There are many other ways to make money in trading, such as bonds, foreign exchange, and commodities. In this post, we will focus on a very special commodity- the yellow metal, gold. For reasons we will explain shortly, gold is particularly amenable to Elliot wave analysis and is therefore an excellent target for traders who use Elliot theory in their strategies. In addition, gold as a commodity can diversify a portfolio that is heavy on stocks, so it might be a good idea to have gold in the mix regardless of how you feel about Elliot theory.

Why Gold

The basic tenets of Elliot wave theory are rooted in human psychology. Elliot believed that cycles of optimism and pessimism governed human emotion and, therefore, trading. The little rises and dips in asset prices are actually the result of these cycles, according to Elliot. That is especially interesting for the case of gold. First of all, gold is particularly emotional compared to other assets in terms of its value. Secondly, because it is such a popular and well-studied commodity, gold presents major opportunities to anyone who can reliably predict its price movements. Thirdly, gold is a useful test of whether or not Elliot’s rules need to be updated to accommodate modern psychological changes.

The basic tenets of Elliot wave theory are rooted in human psychology. Elliot believed that cycles of optimism and pessimism governed human emotion and, therefore, trading. The little rises and dips in asset prices are actually the result of these cycles, according to Elliot. That is especially interesting for the case of gold. First of all, gold is particularly emotional compared to other assets in terms of its value. Secondly, because it is such a popular and well-studied commodity, gold presents major opportunities to anyone who can reliably predict its price movements. Thirdly, gold is a useful test of whether or not Elliot’s rules need to be updated to accommodate modern psychological changes.

The Emotions of Gold

Gold is a commodity with some limited industrial applications and considerable rarity. It is not a stock or bond, which is attached to a company that presumably makes money. Gold itself rarely has much value to the individual traders who hold it aside from its potential to be used as a medium of exchange and any possible future prices changes that could make the gold an investment commodity. Knowing when to enter and exit the gold market is a huge difference-maker in terms of final profit, and gold trading is highly sensitive to the emotional responses of traders to economic conditions. The fact that gold trading is rooted in the emotions means it works very well as an asset suitable for Elliot analysis. More than any other asset, the price of gold reflects the optimism or pessimism of its holders. That is exactly the kind of case that Elliot was trying to predict. That implies that the fluctuations in the price of gold, whether they are over a few minutes or over a few years, should be relatively easy for Elliot analysts to predict compared to other assets. Both the general trend and the internal rises and falls around that trend are predictable in Elliot’s framework. Knowledge of the future price of gold would be extremely valuable. You could make consistent profits on gold positions, either on their own or paired with stock positions. The reason this is all possible is because of how much gold is a barometer of trader emotions.

The Gold Market

There are many players in the gold market, which is quite large. There are individual traders trying to make money, banks and other financial entities looking to hedge risk, and world governments who use gold to manipulate their currency or economy. It is clear right away that all of these groups have different agendas and goals. Understanding this, and their emotions, is key to using Elliot theory to analyze the price of gold. There are so many different kinds of traders that the price of gold can move chaotically, but it all comes down to trying to see which players are moving at which times, and how their emotional state drives their trading decisions. Elliot waves are evident in the price movements of gold on just about any time scale you examine. The market for gold responds strongly to both good and bad news about the economy, which underscores how much trader sentiment influences gold prices. When thinking about the timing of your positions, consider taking this news into account as well as Elliot wave theory. That will help you supplement your analysis with some germane information.

It’s one thing to be a technical analyst, but you need some kind of defined framework to guide you. The gold market is particularly well-suited to technical analysis using the Elliot wave theory because Elliot waves are based on the emotions of traders, and the gold market is an emotional one. The key lies in being able to identify the current wave and use that information to predict the next movement in the price of gold. That kind of knowledge opens up the possibility of making significant profits on a consistent basis.

- Elliott Wave and Fibonacci Relationships: are they real? - December 7, 2015

- Elliott Wave International Review - November 23, 2015

- What is the Elliott Wave Theory/Principle? - November 22, 2015

- The Elliott Wave Principle and Gold - November 18, 2015

- The Elliott Wave Principle in Forex Trading - November 18, 2015

- Elliott Wave DNA Review - November 16, 2015

- Elliott Wave and the S&P - November 16, 2015