The foreign currency exchange market, more commonly known as forex, is the most active, liquid and dynamic trading platform in the world. The rising trend of globalization is directly related to the growing interest in forex; one of the main reasons behind this trend is that many national economies are being transformed by the forces of trade, and thus strong relationships are being forged with regard to currencies.

Like other financial marketplaces, forex is subject to a number of factors and pressures that determine volume, pricing, value, and trends. From geopolitical events to central bank policy and from institutional investors to responsive traders; the forex market offers investors many opportunities that can be turned into strategic positions and profit.

Although forex lends itself to both fundamental and technical analysis, the latter is more often applied than the former. Seasoned traders conduct some level of fundamental analysis for the purpose of getting a general idea of the market’s climate, particularly with regard to the heavy currency pairs such as EUR/USD; however, the bulk of analysis tends to be technical for most forex traders.

Technical Analysis of the Forex Markets

When traders take positions on currency pairs, they do so because they are thinking about price, which is the essential factor of forex. To a great extent, price is the trickle-down result of events that start with currency intervention by sovereign players and interbank participants all the way to day traders.

It is important to remember that the technical analysis approach to the forex markets essentially looks at the history of how human actions and behaviors determined price. If the price level of a currency pair corresponds to a signal of historical resistance or support, forex traders can take market positions that reflect prior actions by other traders.

Why Forex Traders Prefer Technical Analysis

In terms of participation, the forex markets are the most diverse. The big players are the central banks, which enact and apply monetary policy; these sovereign entities are followed by commercial and investment banks that have access to the interbank lending market. The rest of the forex participants operate on over-the-counter (OTC) markets, and they may range from brokerages to trading shops and day traders.

The sheer liquidity of the forex market is greatly owed to this diversity of players, but it is easy to see why the big players generally review fundamentals while individual traders gravitate towards technical analysis. Those with access to the interbank network are privy to economic data and reports that trickle down to brokers and individual traders at a later time; for this reason, average forex traders are better off with real-time quotes and technical analysis.

Technical analysis of the forex markets is based on the principle of history repeating itself because traders are human, and thereby creatures of habit. Central banks can make history with policy and intervention; individual traders can merely react to it, and their reactions can be dissected with technical analysis.

The Wave Principle

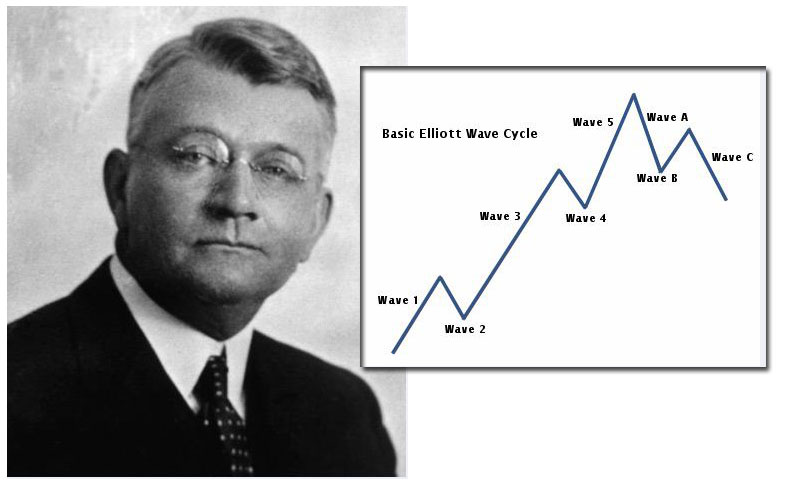

Ralph Nelson Elliott was a numbers man. Prior to the Great Depression, he analyzed more than 70 years of stock market data. Elliott compiled the bulk of his analytical work into The Wave Principle, a groundbreaking book that is considered to be canon in the world of technical analysis. In his book, Elliott posited theories about the collective behavior of traders, which he noticed were cyclical.

When Elliott plotted data into charts for the purpose of visualization, he recognized patterns that look like waves, hence The Wave Principle. Furthermore, Elliott believed that these waves could be studied as fractals, which means that they can be broken into parts for further analysis.

The Five Waves

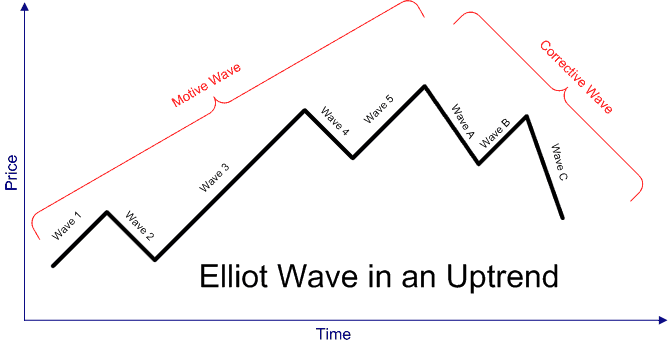

The Elliott wave moves in a fractal pattern of five waves; the first one is an uptick while the second moves down. The third wave is an uptick and so is the fifth one; in other words: waves number one, three and five move up while waves number two and four move down.

For the purpose of trading forex, the Elliott wave can be observed in three degrees. The minor degree is for active day traders who chase one pip after the other; this can be visualized within a 15-minute period. Intermediate degrees can be observed on the hour while major degrees can be seen on daily charts.

Major degrees indicate impulsive behavior by traders on a currency pair; such behavior tends to be associated with long-term market directions as long as there is high volume to justify it. Positions should be taken on the major waves, and they should be exited on the intermediate waves.

An active forex trader using technical analysis charting tools can use the Elliott wave to trade on an hourly basis. To do this, the trader should determine which direction the currency pair is taking by looking at the daily chart and think about target pricing by looking at the hourly chart; the exact timing of the exit point should be determined with the minor degree 15-minute chart.

A Closer Look at Major Waves

The sheer magnitude of the forex market should prompt traders to pay more attention to the major waves. For currency pairs such as EUR/USD, technical forex traders have noticed that majors waves tend to develop in tandem with interest rate moves. As it happens, the track record of profitability by forex traders using the Elliott wave is estimated to be around 50 percent, which is a lot higher than other traders who never apply this principle.

Advanced traders can also look into other fractal patterns of the Elliott wave. Impulse waves are those described above, and they are the most common; however, other waves that can be observed include corrective and alternating waves.

In the end, a masterful use of Elliott waves should not be the only charting and strategic tools used by forex traders; they are, however, a great introduction to technical analysis.

- Elliott Wave and Fibonacci Relationships: are they real? - December 7, 2015

- Elliott Wave International Review - November 23, 2015

- What is the Elliott Wave Theory/Principle? - November 22, 2015

- The Elliott Wave Principle and Gold - November 18, 2015

- The Elliott Wave Principle in Forex Trading - November 18, 2015

- Elliott Wave DNA Review - November 16, 2015

- Elliott Wave and the S&P - November 16, 2015