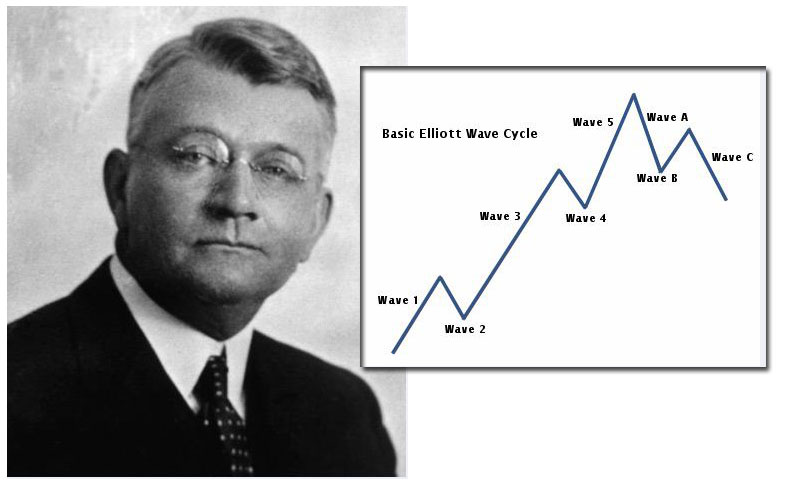

As if Elliott Wave Theory was not sometimes complicated enough for the average person to get his or her head around, the world famous fractal theory about infinite waves and never ending sub waves means that for every Elliott Wave, there is another series of sub waves going on beneath that layer and still another beneath that and so on. This is because all Elliott Waves are fractals. The picture below demonstrates the idea of waves within waves, which we will attempt to de-mystify in this post.

The Elliott Wave Theory Categories of Waves

The powers that be behind the scenes of the Elliott Wave Theory decided on a number of category names for all of these waves and sub-waves to help differentiate the most important ones from each other and to avoid utter confusion when discussing sub waves within waves. These are named accordingly from biggest time frame waves to smallest ones. From largest to smallest, they are as follows:

- Grand Supercycle (multiple centuries time frame)

- Supercycle ( generally considered to be from 40–70 years in length)

- Cycle (from one year long to several years in length)

- Primary (several months to a couple of years long)

- Intermediate (from several weeks to several months long)

- Minor (a matter of weeks in length)

- Minute (a matter of days in length)

- Minuette (mere hours long)

- Sub-Minuette (mere minutes long)

The simplest way to understand this all is that the highest and top level wave is the Grand Supercycle Wave. This enormous time span wave is comprised of still impressively large Supercycle Waves. They in turn are comprised of Cycle Waves which are made from Primary Waves. Primary Waves have Intermediate Waves as components, while these are made up of smaller still Minor Waves, comprised of Minute Waves, and finally made up of first Minuette Waves and then Sub-Minuette Waves.

How an Elliott Wave Looks In Real Life

This chart shows you that these waves and their infinite numbers of sub waves are not perfectly shaped whatsoever in actual everyday life. It is also true that it can be challenging to label these waves and sub-waves. Yet it is important to get down to the brass tacks of at least a few layers of these waves as their time frames make them critical to understand if you are going to attempt to first comprehend and then trade them.

A More Detailed Look at the Top Three Levels of the Waves

Grand Supercycle Waves

Before Elliott died, he spoke and wrote extensively about a super wave which he labelled a GSC Grand Supercycle Wave that might last as long as 300 years. This Grand Supercycle Wave proves to be the longest wave period during the growth of financial markets as detailed in Elliott Wave’s Principle. Although Elliott himself advanced the theory that the first grand Supercycle advance had begun in the U.S. stock markets back in 1857 and run to the year 1928, he later admitted that it was possible this was in fact the third or possibly even fifth wave of a Grand Supercycle. Later on, his ultimate master disciples Robert Prechter and A.J. Frost reevaluated the data sets and expanded them all the way into the 1970’s to discover that the Grand Supercycle Wave of U.S. stocks actually began in 1789 when stock market data first existed and is set to conclude in the early part of the 21st century. This interpretation is critically important because as more modern data and theory demonstrates that this great Grand Supercycle Wave is finishing up now, it will soon be followed by a scary corrective price pattern of serious decline which will prove to be the biggest economic styled recession since the 1700’s.

Supercycle Waves

According to Elliott Wave Theory, and in particular that newer interpretation and extrapolation of it based on Prechter and Frost’s impressive and insightful work, the latest Supercycle itself began back in 1932. This is especially important as the waves demonstrate that we are now in the very tail end of the Fifth Wave of this current Supercycle. Here is the breakdown of the five waves within this current and critically important Supercycle that has nearly run the end of its full course:

• Wave I: From 1932 to 1937 – The beginning and classic first of five waves in this particular and still present day Supercycle is traditionally Elliott. It retraced .618 (important Fibonacci level) of the crushing stock market decline considering the 1928 to 1930 highs.

• Wave II: From 1937 to 1942 – This wave represented a classic zigzag formation with its five subwaves. The damage of Wave C was quite erosive, with continuous deflation causing stock prices to reach PE levels that were even lower than those reached in 1932.

• Wave III: From 1942 to 1965(6) – During this rising wave, the Dow Jones rocked up almost 1,000% in a mere 24 years.

• Wave IV: From 1965/6 to 1974 – This wave clearly represented an A-B-C declining pattern, as shown in the chart below.

• Wave V: 1974 to ? – This Supercycle Wave is most important of the five as it is still unfolding before our very eyes. It seems most likely that the two Cycle Waves are now completed with the market currently tracing out its third Cycle Wave. This is why it accompanied a breakout in the markets to another new all time high in the past few years.

All this is to say that Elliott would describe the current economic wave cycles as the fifth wave from the 1932 Supercycle of the fifth wave from the 1789 Grand Supercycle all couched within the extended still higher level master third wave that began in the Medieval or Dark Ages. This chart below tells the tale in easier to understand visual terms.

Cycle Waves

The last level of waves that we will consider here are these third tier waves within waves simply called Cycle Waves. As these run from a single year long to a couple of years in length, this would likely put this cycle of sub waves within this century entirely. That means that such things as the recovery off of the dot com crash, the explosion in the stock market to 2006, the collapse of 2007 -2008, the recovery from 2009 to 2015, and the correction since 2015 would all be part of the five waves up, three waves down Cycle Waves set in some interpretations.

Final Words on Sub Waves Within Elliott Wave Cycles

This is a very practical application of Elliott Wave Theory as it pertains to our own immediate day and time and the next few years of the future. Smaller subset waves within the larger waves including from Primary Waves level on down to sub-Minuette Wave levels would mostly only matter to day traders, swing traders, and shorter term traders as you are now looking at waves whose various five up and three down wave components only run from several months to a single year on down to mere minutes. These are not practical Waves to review and discuss for anyone with a longer trading horizon than a few weeks to a month or two at most. It is enough to understand the top three and most practical levels of waves in the form of the Grand Supercycle, the Supercycle, and the Cycle Waves of Ralph Nelson Elliott’s ingenious theory.

- Using Counting Fractals to Find Elliott Waves - May 19, 2016

- The Grand Supercycle Controversy - May 19, 2016

- Robert Prechter’s Enduring Impact on Elliott Wave Theory - May 12, 2016

- Elliott Wave Gold Review - April 29, 2016

- Common Objections to Elliott Wave Theory - April 28, 2016

- What Are Elliott Wave Theory’s Waves Within Waves About? - March 8, 2016

- Review of the New Classic Among The Elliott Wave Theory Books, “The Elliott Wave Principle” - February 25, 2016

- Reviews of 2 Classic Elliott Wave Theory Books - February 25, 2016

- The Origins of Elliott Wave Theory and How it Was Discovered - February 13, 2016

- Elliott Wave Stock Market Review - February 5, 2016