Elliot wave theory is a type of technical analysis. There are two ways to analyze asset prices: technical and fundamental. Fundamental analysis involves examining the value of the underlying asset and technical analysis means using statistics and mathematics to predict price movements. Elliot wave theory is one of the leading forms of technical analysis. It draws on the emotional cycles inherent in human nature to predict how the price of assets will change in the future. The time span can range from hours to months, and you can use Elliot wave theory for any asset, whether it is a stock, bond, currency pair, commodity, or something more exotic. In this post, we will dive into the history and meaning of Elliot wave theory and talk about how you can use it for your own investing and trading.

History of Elliot Wave Theory

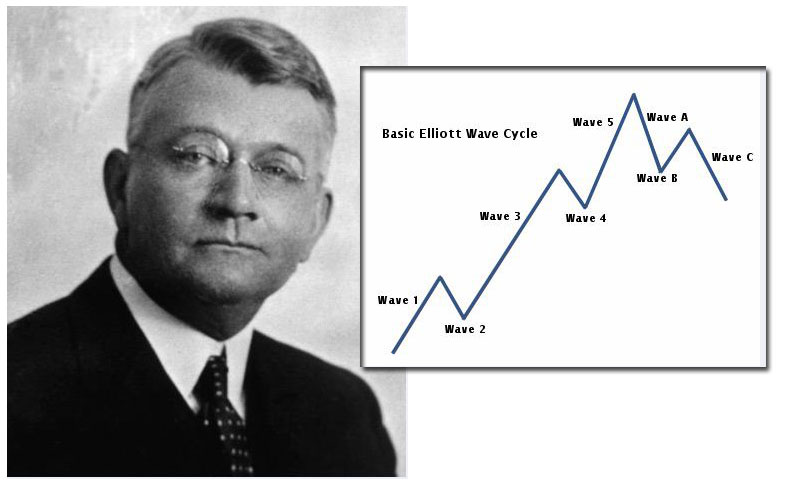

The man behind Elliot wave theory was Ralph Elliot, an accountant who studied asset pricing in the first half of the 20th century. He wanted to find a way to predict how prices would move, and he believed that the key lay in human psychology. After all, it’s people who create asset prices by trading those assets in the market. Understand psychology, and you understand the market. That is the general idea, and Elliot went on to develop a concrete theory that he felt reflected human nature and turned that knowledge into specific predictions about market behavior.

The basic insight in Elliot theory is that the human mind goes through alternate cycles of optimism and pessimism. These upswings and downswings affect how traders view the market and how they trade. The cycles translate directly into the titular waves that appear in any graph of an asset’s price. It’s true- the graph of, say, a stock’s price always look jagged and wavy, not smooth. Elliot hypothesized that these waves came from cycles in the minds of traders, and that therefore the waves were predictable. By understanding human nature, it is possible to know how asset prices will move. Elliot codified this concept in his theory of waves, which makes specific predictions about the way asset prices move up and down.

Details of Elliot Wave Theory

The basic rules of Elliot wave theory are simple. There is always a dominant trend in the market which determines the direction in which asset prices are moving. In addition, there are waves that push the prices up and down in smaller movements. The waves come in groups. First, there is a set of five waves- three with the trend and two against- that establish a trend. Then there is a set of three waves that reverse the trend. This is followed by another set of five waves that align with the new trend, then another three to return to the original trend, and the cycle repeats. Every wave has its own personality, because they all derive from different elements of human personality. The third wave of the five-wave cycle tends to be strongest. Each wave has a specific timing with respect to general economic news. The different sizes of the waves and the ways they interact with news means it is possible as an observer to look at a market and know where it is in the cycle. Savvy traders will be able to examine an asset, determine which wave it is currently experiencing, and predict the next few waves, both in direction and in size. The ability to know the next few price movements for an asset means you can either buy or sell in accordance with where the price will move, netting you a profit.

Using Elliot Wave Theory

Knowing the basics of Elliot wave theory and applying it to a real-world trading situation are quite different. Every asset is a little bit different, although the basic patterns are always the same. For example, some assets react more strongly to economic news than others. That has implications for the size and timing of waves. Elliot wave theory is not just a way to make price predictions. It also lets you set useful stop losses to ensure that you are on the right path: you can use stop losses to cut off your own trading if it turns out you misread the market and it is not in the wave you thought it was. It is possible to use Elliot waves to look at price movements on nearly any timeline, so determine the time horizon that you are comfortable using and then trade in accordance with your risk level. It might take some time to get acclimated to a new asset or a new market, but persistence yields rewards. Elliot wave theory is a comprehensive way to use psychology to predict markets, so studying the waves means you will be able to take advantage of the unconscious emotional states of your fellow traders to make money.

Check out the video below that explains how the Elliott Wave Principle applies to trading:

- Elliott Wave and Fibonacci Relationships: are they real? - December 7, 2015

- Elliott Wave International Review - November 23, 2015

- What is the Elliott Wave Theory/Principle? - November 22, 2015

- The Elliott Wave Principle and Gold - November 18, 2015

- The Elliott Wave Principle in Forex Trading - November 18, 2015

- Elliott Wave DNA Review - November 16, 2015

- Elliott Wave and the S&P - November 16, 2015