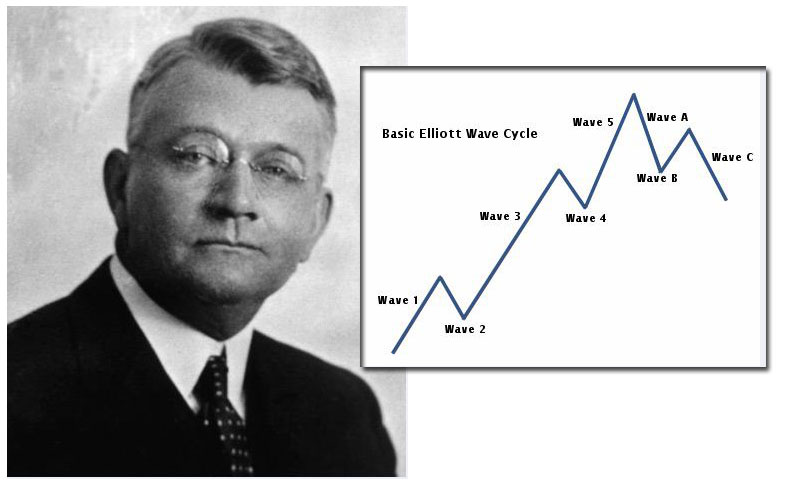

The father of the much-discussed Elliott Wave Principle turns out to be the man for whom it was named, Ralph Nelson Elliott. He came into the world on July 28, 1871 in Marysville, Kansas. Though he worked a variety of interesting and important jobs throughout his life, the legendary figure did not achieve his ultimate purpose and calling until much later in his life, and this was all thanks to the seemingly ill luck of contracting a debilitating disease.

Elliott actually worked in a range of business and accounting roles throughout his life until an illness that he contracted during his time living in Central America forced him to retire at the tender age of 58. Elliott found himself bored and in desperate need of something useful to busy his mind while he recovered. Thus he applied his considerable mental prowess to the subject of the stock market and its often irrational-appearing behavior.

Elliott started by considering and analyzing the half hourly, hourly, daily, weekly, monthly, and yearly charts of the major stock market indices and behavior over 75 long years. He worked on this with a passion until November of 1934. At this point, his ideas had matured to the confident level that he felt comfortable sharing them with Charles J. Collins of the Detroit-based Investment counsel, Inc. Collins was typically not very impressed with the many people who corresponded with him regarding systems and concepts for outperforming the stock markets. This resulted largely from the overwhelming majority of such systems being nothing but abysmal failures. Elliott’s Wave Theory turned out to be a different story altogether.

Through the early months of 1935, the Dow Jones averages had shown declines. Stock market analysts and advisors had soured on the prospects for the market in memory of the severe 1929 – 1932 collapse which still weighed heavily on most of their psyches. Elliott studied the situation and determined on Wednesday, March 13, 1935 that the DJ averages had finished trading at or near the lows for the year on that day. Elliott cited his Wave Theory results and prognosis in sending out a telegram to Mr. Collins. In this, he flatly announced, “Notwithstanding bearish Dow implications, all of the averages are making a final bottom.”

Elliott could not have nailed it any better than with that declaration, as the following day of Thursday, March 14th in 1935 saw the closing lows on the Dow Industrials for the year. The 13 month decline had ended, and markets sprang towards the upside immediately. After watching this action for two months while the markets continued their upward romp, Collins at last agreed to co-author a book on Elliott’s Wave Theory. Three years later on August 31, 1938 saw the publication of The Wave Principle.

Elliott did not rest on his laurels after the book came out and achieved some success. Throughout the war years of the 1940’s, he kept developing his Wave Theory further and improved on it by tying his observations on collective human behavioral patterns to the golden Fibonacci ratios. This mathematical explanation for the various levels of support and resistance in the markets had been understood for millennia to be one of the natural laws that governed both progress and form in the universe. Elliott began working on his Magnum Opus in these years, his definitive Nature’s Law – The Secret of the Universe. In this tremendous work, he laid out every idea he had ever conceived of regarding his growing Wave Theory and Principle.

What Elliott Wave’s Principle Is Really All About

It is no exaggeration to state that because of Elliott Wave’s ground breaking research back then, today literally thousands of individual traders, professional and private investors, and institutional portfolio managers utilize his Elliott Wave Theory as the basis of their decision making in investments. Yet what is this principle that attempts to explain not only investments, but the world in general, really all about?

This Elliott Wave Principle proves to be a highly detailed description of the ways and means that groups of individuals respond to events collectively. What it demonstrates is that the psychology of the masses literally swings from pessimism to optimism and then back again according to a naturally occurring sequence. In the process, it makes particular, identifiable, and most importantly even quantifiable patterns along the way. It is true that among the easiest to spot elements of the Elliott Wave Theory hard at work is with the financial investment markets. This is because the psychology of investors that is changeable and measurable is tangibly recorded as price movements in the major stock market averages. By being able to identify patterns of prices that recur, and then to analyze at what place we actually are within those recurring patterns now, you can in theory forecast where precisely we are heading next.

How Elliott Wave Theory Predicts Investor Psychology

As it so happens, the true engine powering the stock markets is actually investor psychology. This is what the Elliott Wave Principle purports to measure and then predict. It is intuitive with stocks, since when individual investors turn optimistic on the future prospects of a particular stock or market, then they proceed to bid or drive the underlying price higher. There are two cases that will help you to see this more clearly and definitively.

Over the course of hundreds of years, investors have seen that regardless of how serious external events might actually be, they really have no meaningful impact on the stock markets’ overall progress. In other words, identical news which today might cause the markets to seemingly rise could just as easily cause them to plummet tomorrow. There is truly only one reasonable conclusion that you can come to from this erratic behavior. This is that the markets really do not consistently react to external events. The second case is that when you pour through the historical stock market charts, you quickly observe that the market movements pretty consistently occur in waves.

Utilizing this Elliott Wave Theory is a probabilities game. Elliotticians are those individuals who are best capable of correctly analyzing and identifying the structure of the markets and anticipating the move that is next likely to happen based on where the market lies within those greater super cycles. When you understand the various wave patterns, you learn what the markets will most probably do next, as well as the reason why this will occur, and also what things that they will in fact not do. It is with this fantastic Elliott Wave Principle and Theory that you are able to most correctly ascertain the greatest likely moves that entail the lowest amounts of risk to your endeavors and trades.

In Conclusion

Too many individuals who know something about the Elliott Wave Theory are altogether ignorant of the fact that Elliott Wave attempts to explain all manners of behavior in the world around us, and not just the group behavior of the investing masses. This capability of explaining the way that the world works can be seen as simply as when a still pool of water is disturbed by a rock, as the waves that emerge from the splash are symmetrical and can be logically predicted and also explained. So too with investor behavior, it is neither random nor impossible to understand and explain. The moves up and down in the stock markets all occur as reactions to the previous movement. Rallies spring from psychological reactions to declines, while pullbacks emerge from overblown rallies as the mass investor psyche catches up with this too. By studying Elliott Wave Theory and Principle, you not only improve your ability to understand and trade the stock markets, but you become a better student of human nature and all around behavioral patterns as well, something that is sure to help you out in the course of your daily life.

- Using Counting Fractals to Find Elliott Waves - May 19, 2016

- The Grand Supercycle Controversy - May 19, 2016

- Robert Prechter’s Enduring Impact on Elliott Wave Theory - May 12, 2016

- Elliott Wave Gold Review - April 29, 2016

- Common Objections to Elliott Wave Theory - April 28, 2016

- What Are Elliott Wave Theory’s Waves Within Waves About? - March 8, 2016

- Review of the New Classic Among The Elliott Wave Theory Books, “The Elliott Wave Principle” - February 25, 2016

- Reviews of 2 Classic Elliott Wave Theory Books - February 25, 2016

- The Origins of Elliott Wave Theory and How it Was Discovered - February 13, 2016

- Elliott Wave Stock Market Review - February 5, 2016