As we saw in last week’s post, Elliott Wave Theory did in fact predict the present stock market decline that has so far gripped the markets with fear and trembling (albeit not yet quite anything remotely like panic) since even the end of 2015 and all of January 2016 so far to date. The question for the ages now that the markets have fallen into official correction territory this past week surely must be, “Does Elliott Wave Theory demonstrate or point to a bottom in this latest correction or even bear market run that is already presently underway?” Fortunately for the followers and fans of Elliott Wave Theory, it does have much to say about how low and how long this presently already underway market correction could in fact go in the coming months and even beyond.

What the Elliott Wave Grand SuperCycle Is Telling Us About The Present Stock Market Action

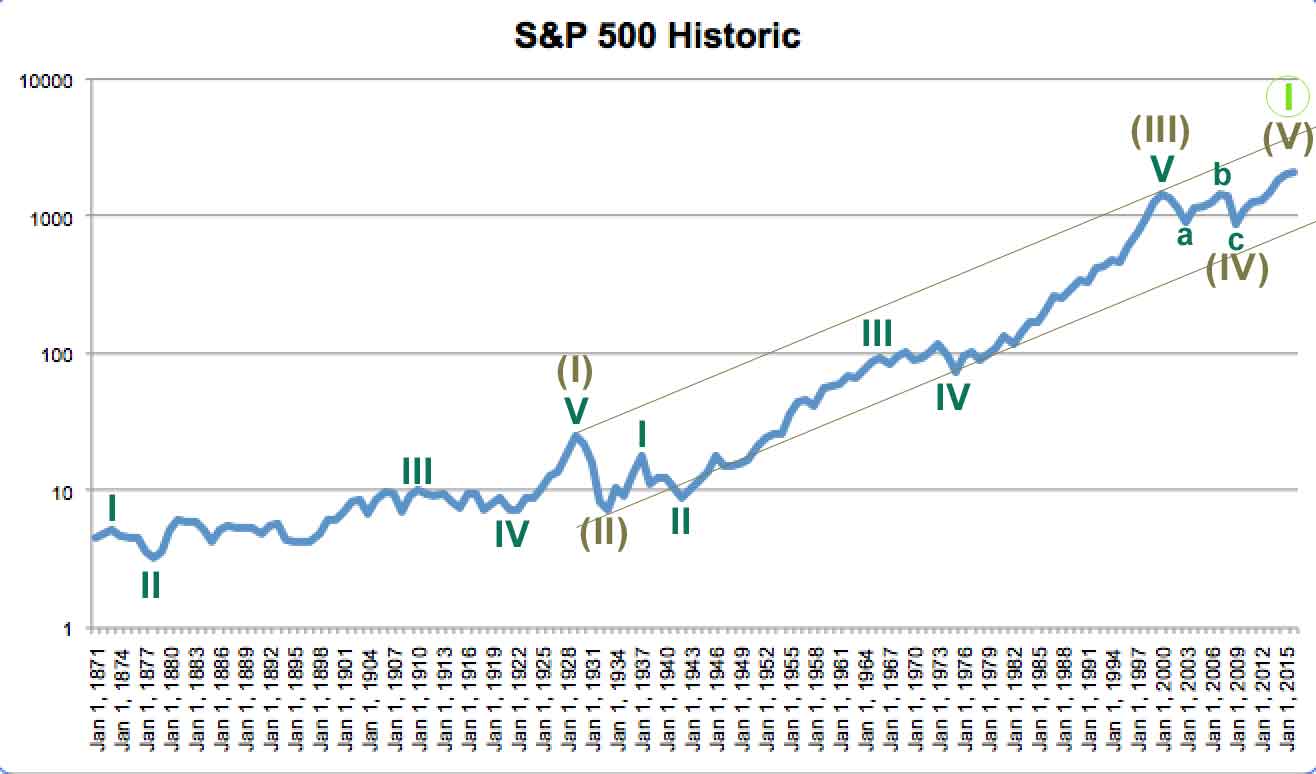

Take a good look at this Elliott Wave SuperCycle historical chart of U.S. stock market S&P 500 and overall stock market going back to 1871.

You can have a go at the long term charting of the stock market in one of two valid approaches. Either you may examine the data from the S&P 500 that goes back to its founding in 1957, or you can amalgamate the whole of U.S. stock markets before that point in your calculations and count the entire U.S. stock market up to 1957 as the equivalent of the present era S&P 500 index. This chart shows the whole market according to that second option and going back to 1871.

According to this Elliott Wave SuperCycle chart, we have reached or nearly reached the end of upmarket wave I in the stock market as a whole for this particular cycle. Historically per the previous two collections of five waves, the market has now reached that most unpleasant point where the wave 2 correction downward gets underway. As you can see from looking at the first SuperCycle going back to 1871 to 1931 and the second SuperCycle that ran from 1937 to 1997, in each of the prior Wave 2 formations, the stock market index (or overall stock market standing in for the S&P 500 itself) proceeded to retrace by almost or more than 50% during this second wave. If the SuperCycle portion of Elliott Wave Theory holds true and chilling history repeats itself yet again, then this phase of the Wave 2 correction could easily see the S&P 500 market drop by around half, or 900 to 1,000 points to around a thousand total level. With the S&P 500 already down 10% and still at around 1,900, that would indicate that a potentially 900 or more points painful drop is in the cards.

Can you imagine the financial chaos that would be brought on by another 900 points decline in this most important of indices (and keeping in mind that a comparable drop in the Dow Jones would be somewhere between 8,000 and 10,000 points!). Look at how terrified world economic and political leaders all appeared at the annual Davos, Switzerland World Economic Forum this past week and imagine if the S&P 500 had not recently dropped by around 200 points in January, but instead to the order of 900+ points, and then you will understand where we are going with this idea. That is the current Elliott Wave Theory SuperCycle prediction; let us hope, though not believe too seriously (or behave like), that it is actually wrong.

The Bear Elliott Wave Theory Count

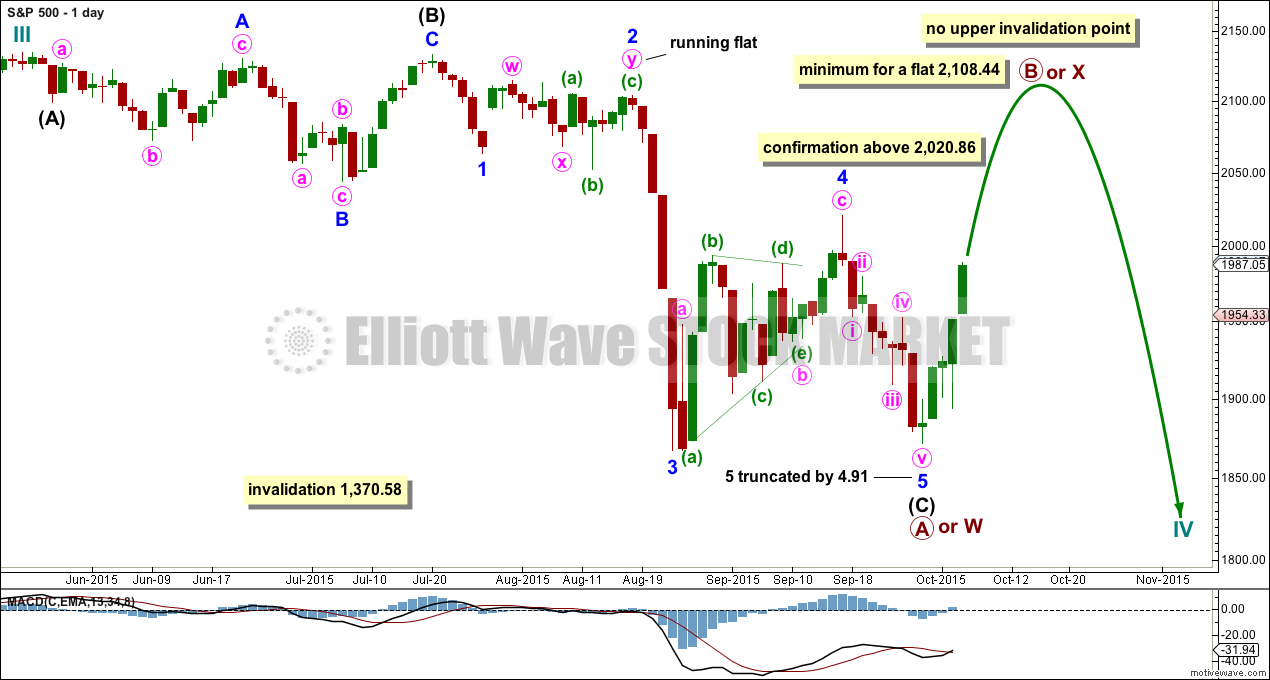

You have already seen how the super cycle analysis and chart demonstrated the timeliness of the bear picture for the stock markets in general and the S&P 500 index in particular. Taking a look at the daily chart reveals a similar picture unfortunately. See this Elliott Wave Theory Bear Daily Chart to understand what we are talking about here.

BEAR ELLIOTT WAVE COUNT

DAILY CHART

The biggest worry about this chart showing the waves is that no lower invalidation point for this bearish wave count presents itself. This means in layman’s terms that there actually is no lower limit or even target to the bear market in which we find ourselves caught today. These are grim and grave words, but better you should hear the potentially worst case scenario and prepare yourself and your stock market positions and portfolio accordingly, while you still can.

January of 2016’s downward movement to this point still appears to be a third wave. Sadly, this third wave in the intermediate wave 3 still has plenty of room lower to run. It would need to move still lower below the price territories of the intermediate wave 1 to set up enough room for the following fourth wave and correction to transpire, and the Elliott Wave rules state that this ensuing fourth wave must be lower than the price territory of intermediate wave 1. This means that a temporary bottom would not be in place until the S&P 500 drops below 1,867.01, nearly 40 points below where the markets are now. At least this shorter term only 40 points prediction lower in the daily charts is a lot easier to stomach forecast than is the longer term target of from 900 to 1,000 points lower predicted in wave 2 of the current Elliott Wave Theory Super Cycle prediction.

What Dow Theory Has to Say About These Predictions

Remember from our discussion in the last two posts about how the grandfather and precursor of Elliott Wave Theory is the venerable Dow Theory. Dow Theory weighs in on the present situation and matches up with the Elliott Wave Theory forecasts nicely. Looking at the S&P 500, Dow Transportation, Dow Jones Industrial Average, the Nasdaq Exchange, and the Russell 2000 Index, so far the DJ Industrial Average, DJ Transportation Average, and the Russell 2000 Index have all set new major swing lows, while none of the aforementioned indices have approached anything like new highs. This means that only the S&P 500 and the Nasdaq Indices stand in the way of and have yet to confirm the pending market crash per, Dow Theory. Where does this leave us ultimately then for the near and intermediate term future of the various widely followed and critical stock market indices? Three of five Dow Theory benchmark indices have already hit their swing low thresholds, and daily and Super Cycle Elliott Wave Theory charts are screaming for a substantial correction that will probably look and feel like a depression, if not just a major bear market.

In Conclusion

If the Nasdaq and S&P 500 indices do make their new major swing lows as anticipated, then Dow Theory will add its loud voice to the rising chorus of warnings that a massive new bear market has fully reared its ugly head and has in fact already begun. A warning word to the wise is sufficient. Needless to say, you had better watch those stop loss orders on your open stock market positions and keep them extra tight while remembering that they are never guaranteed to fill at the point at which you set them for in the event that the market crashes right past and through them. The exit doors always become overwhelmingly crowded at the point when the stampede rush for the exits has already begun in earnest. Do not get caught in the crush of people trying to get out of the proverbially burning building.

- Using Counting Fractals to Find Elliott Waves - May 19, 2016

- The Grand Supercycle Controversy - May 19, 2016

- Robert Prechter’s Enduring Impact on Elliott Wave Theory - May 12, 2016

- Elliott Wave Gold Review - April 29, 2016

- Common Objections to Elliott Wave Theory - April 28, 2016

- What Are Elliott Wave Theory’s Waves Within Waves About? - March 8, 2016

- Review of the New Classic Among The Elliott Wave Theory Books, “The Elliott Wave Principle” - February 25, 2016

- Reviews of 2 Classic Elliott Wave Theory Books - February 25, 2016

- The Origins of Elliott Wave Theory and How it Was Discovered - February 13, 2016

- Elliott Wave Stock Market Review - February 5, 2016