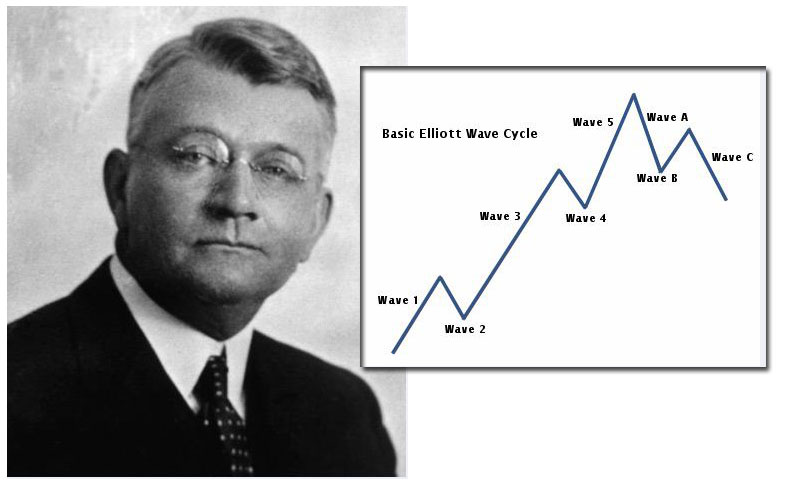

When Ralph N. Elliott created his Elliott Wave Theory that Robert Prechter later made popular, it is unlikely that either of them had any idea about how much controversy the theory would create decades later. The idea starts with the assumption that the behavior of crowds goes back and forth in trends which are clear and identifiable like rippling waves. Part of Elliott’s genius lay in coming up with a structure that defined price movements in financial markets. Unfortunately, not everyone has been able to grasp the sometimes complex ideas. Other critics have run afoul of technicians who improperly interpreted parts of the theory. Below are four objections that people have raised with regards to the Elliott Wave Theory and the explanations for them.

Objection 1: The Future Is Unknowable, Even By Elliott Wave

It is true that people can not successfully predict the future in every case. Yet somehow the market manages to do this most of the time by discounting news and events long before they happen. This is partially explained by Elliott Wave’s premise that the behavior of crowds is essentially much easier to predict than that of a single person or a few individuals. How does this apply to charts and markets anticipating news? There are always individuals in companies who know in advance that bad news or a bad earnings report will soon be released. Predictably, those in the know begin massively selling off their stock shares. There are also other investors who watch for company insiders to do this and then do the same. Still other people watch these investors and the cycle continues ad infinitum. The next thing you know, the stock price drops sharply even weeks or months before the bad news emerges.

Ultimately it is supply and demand that drive markets in any case. The masses drive demand. As Elliott Wave has noted, the behavior of these masses is far more predictable than that of a few individuals. This behavior also tends to repeat itself. It is not just R.N. Elliott who presupposed this theory. Technical analysts as a rule agree with the idea that individuals as part of a larger group act in predictable and repetitive behavior patterns. This is true not just with financial markets, but with life in general.

Objection 2: There are So Many Different Elliott Wave Interpretations from Different Experts

The truth is that often times Elliott Wave Technicians will have differences of opinion from each other. Other times, they agree on their prognosis. This is not unique to Elliott Wave Theory. In fact, with any different type of market analysts you see the same phenomenon. If you watch the major money channels like Fox Business, CNBC, or Bloomberg you will see market analysts who are supposed to use the same basis in their interpretation coming up with different opinions in their outcomes. Some will argue for bearish markets or stocks, others for bullish ones, and even a few will argue for sideways markets.

Even analysts who employ mainstream technical analysis commonly have differences of opinion on what the markets will do in the future. This is just as true for followers of fundamental analysis. It holds for practitioners of the Elliott Wave Theory as well. One Elliott Wave Theorist is not obligated to agree with another one who uses the same professional title. Besides this, no system is correct 100% of the time.

Objection 3: Elliott Wave Technicians Have Predicted the Market Would Crash When It Instead Went Up

There is always the charge that an Elliott Wave Technician has been wrong with what they predicted in the past. Sometimes one of them has said that markets would crash horrifically and then markets took off instead. Making this argument assumes that there is no room for different interpretations within the Elliott Wave Theory. In fact all analytical tools can be interpreted incorrectly even by intelligent and well meaning individuals. There are times when the information is insufficient to make the right prediction. Other times, an Elliott Wave technician simply misinterpreted the information that was available. Neither of these cases mean that the theory itself is invalid or does not work properly. There is no such thing as an analyst who is right all of the time.

Objection 4: Elliott Wave Experts Have Completely Reversed Their Predictions

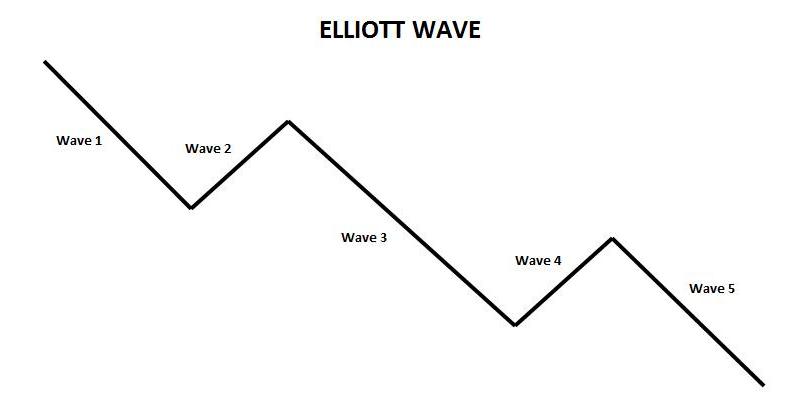

The fact that some Elliott Wave technicians have reversed their predictions is a common objection that critics have levelled. A number of different explanations address this particular criticism. Reputable Elliott technicians take the information that they have and try to count the waves. They do this in the manner that is most likely to be true according to their own analysis of the data they have. This is what is known as their preferred wave count. The fact is that this is fairly complex theory and sometimes it is not completely clear which data represents the wave in question. There are also waves within waves that further complicate their counts. Based on getting the wave count wrong, it is possible to have the opposite prediction of what actually comes to pass. In this case, a good Elliott Wave theorist will admit that he or she was wrong.

Sometimes the market does not clearly reveal what will happen ahead of time. Other technicians may use a different kind of non-Elliott Wave pattern that does not work out and then alter their target accordingly. Elliott Wave Theorists are in the same proverbial boat with their patterns and waves. Because of the complicated nature and background of Elliott Waves, it is difficult for the Elliott Wave Technicians to explain why this could happen in the less than half a minute that financial commentators give them.

- Using Counting Fractals to Find Elliott Waves - May 19, 2016

- The Grand Supercycle Controversy - May 19, 2016

- Robert Prechter’s Enduring Impact on Elliott Wave Theory - May 12, 2016

- Elliott Wave Gold Review - April 29, 2016

- Common Objections to Elliott Wave Theory - April 28, 2016

- What Are Elliott Wave Theory’s Waves Within Waves About? - March 8, 2016

- Review of the New Classic Among The Elliott Wave Theory Books, “The Elliott Wave Principle” - February 25, 2016

- Reviews of 2 Classic Elliott Wave Theory Books - February 25, 2016

- The Origins of Elliott Wave Theory and How it Was Discovered - February 13, 2016

- Elliott Wave Stock Market Review - February 5, 2016