How Well Does Elliott Wave Work on Forex Trades?

Elliott wave has been utilized to predict many different things in the world, from science, to nature, to investing. While it is well known to work as a guiding principle in stock market investing, how well does Elliott Wave work for Forex currency trading? The answer is a pleasant surprise for Forex traders in search of reliable strategies to help them put together more winning trades.

The interesting fact about the Elliott Wave principle is that it actually works most effectively and accurately on those markets that claim the biggest public following. Fortunately for Forex, this is the largest traded and tradable market on the planet. Because Forex boasts enormous size and liquidity (greater than that found in all of the world’s stock markets combined), as well as a simply incredible range of people participating, Elliott Wave Theory commonly displays wave patterns that are most clear and which traders can put to their consistent advantage. In fact, Elliott Wave Theory will cheerfully deliver high probability for accuracy, low risk/high reward trading entry points in line with the prevailing trend.

Besides this propensity for Forex to be well represented by Elliott Wave theory, it is also a helpful trend that the major Elliott Waves typically develop alongside the interest rate specific cycles for currency pairs being traded. All this is to say that Elliott wave scenarios which are potentially profitable happen around 50% of the time in currency markets. Because of this high degree of success, forex traders who are not conversational about and watching out for Elliott Wave patterns are only hurting their own cause.

The Types of Waves that Work Best for Forex Trading

There is a caveat to remember with Elliott Waves with currency Fx trading. The best and most effective waves to watch for are those with only three degrees— major waves which are completely visible on daily charts, intermediate waves that can be completely seen on hourly charts, and minor waves which are completely visible on 15 minute charts. These intermediate waves are created by minor waves, while the intermediate waves themselves actually form the major waves. It is best for Forex traders to employ either major impulse or corrective waves to forecast longer term direction of the markets. Trades perform best when they are entered at the start of the wave and then exited by the conclusion of the major wave’s intermediate impulse waves. Minor waves of the intermediate ones work best for timing trades. For those who plan to trade hourly Elliott Waves, it is wisest to utilize the daily waves for determining the prevailing trend’s direction and then to employ the 15 minute waves for trade entry and exit timing.

Using the Elliott Wave Oscillator Tool

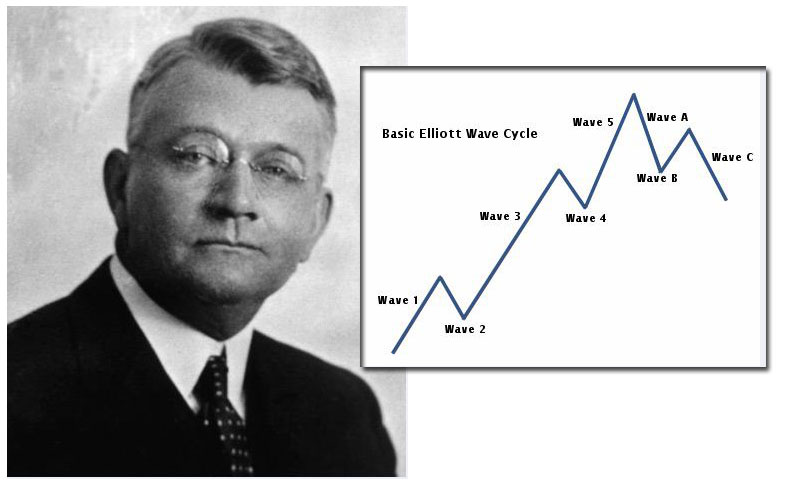

The basic pattern of a standard Elliott Wave looks something like this:

The trend is a trader’s friend, and thanks to Elliott Waves they can understand and anticipate these impulses where the trends actually happen. What trips up so many traders who are trying in vain to make Elliott Wave theory work for them is finding the trends that are actually worth trading. This is another matter entirely. Real time identification of these waves is in fact where the majority of traders become frustrated and abandon the Elliott Wave process altogether.

Getting Around the Most Difficult Part of Using Elliott Waves in Forex

While Elliott Wave reliably gives traders advance knowledge of likely future wave moves, the problem comes in reliably and accurately knowing which wave is which when and as they develop. This is why it is helpful to use the additional tool the Elliott Wave Oscillator, or EWO. Thanks to the utility provided by this Elliott Wave Oscillator, traders in Forex are able to count the various waves even while they are still developing. Such an ability would make even an average trader better than average because of the advantage it provides in being able to see and predict the coming moves.

This EWO tool is so very effective because it allows traders to figure out both the trend and the all-around market movement pattern so that they can put this to work for their strategies in the future. The oscillator is most powerful because of its ability to strongly correlate with the Elliott Wave patterns themselves. The main thing to remember with the Elliott Wave Oscillator proves to be that the readings which are strongest will nearly always demonstrate where on the chart the third wave will land. Though this EWO functions in any time frame, it works most reliably and efficiently if traders allow a big enough price sample for the oscillator. While at first traders will want to put labels on the chart personally, eventually they will be capable of finding the waves without labeling them, given some practice.

Reading the Elliott Wave Oscillator

Using the Elliott Wave Oscillator to help pick out the new waves is a sound strategy once traders understand how this oscillator works in practice. The newly forming waves typically start out from a divergence in the price and indicator. Trend reversals are the place where traders commonly discover Wave 1.

Since markets commonly ebb and flow rather than run in a single direction for long, Wave 1 experiences a normal correction. In such a correction of price, the Forex market or currency pair will never hit an extreme point lower or higher than the previous low or high made, but it will retrace a good percentage of that first Wave 1. As the correction occurs alongside the EWO, traders will see emerging a Wave 2 and later a Wave 4, the corrections. Opportunities on these two waves are quite limited and not really worth trading. It is the big Wave 3 that traders are after.

The strongest movement in price, or Wave 3, occurs after retracement Wave 2 has subsided. Both the indicator and the market will attain newer highs or lows, depending on which direction Wave 1 went. EWO gives the signal to trade this impressive Wave 3, but unfortunately it will not deliver any exit points data. Because of this limitation in the oscillator, it is wise to set up a profit exit order in the 100% to 161% profit price range.

As far as Wave 5 goes, the forex markets will many times achieve a newer high, yet the oscillator itself will not exceed the top of Wave 3 at this point. This creates a divergence in the chart between the price and the EWO. It happens just before a reversal occurs, and this is helpful to know for trading purposes as well.

Learn Forex –Elliot Wave Oscillator Showing Divergence

Final Words on Elliott Wave Theory in Forex Markets

The truth is that Elliott Wave theory, while extremely useful in predicting Forex market moves, is not for the slow witted. The subject is large and involved enough that whole books are written on only it. Traders should be patient, invest sufficient time in understanding the waves and the theory and how it relates to Forex pairs and markets, and finally become fully comfortable with the various setups in trading these impulse waves. After charts reveal potential entry points that are with a high probability of success, it is prudent to enter the first trades with powerful and effective risk management levels and loss-cutting exit strategies in place.

- Using Counting Fractals to Find Elliott Waves - May 19, 2016

- The Grand Supercycle Controversy - May 19, 2016

- Robert Prechter’s Enduring Impact on Elliott Wave Theory - May 12, 2016

- Elliott Wave Gold Review - April 29, 2016

- Common Objections to Elliott Wave Theory - April 28, 2016

- What Are Elliott Wave Theory’s Waves Within Waves About? - March 8, 2016

- Review of the New Classic Among The Elliott Wave Theory Books, “The Elliott Wave Principle” - February 25, 2016

- Reviews of 2 Classic Elliott Wave Theory Books - February 25, 2016

- The Origins of Elliott Wave Theory and How it Was Discovered - February 13, 2016

- Elliott Wave Stock Market Review - February 5, 2016