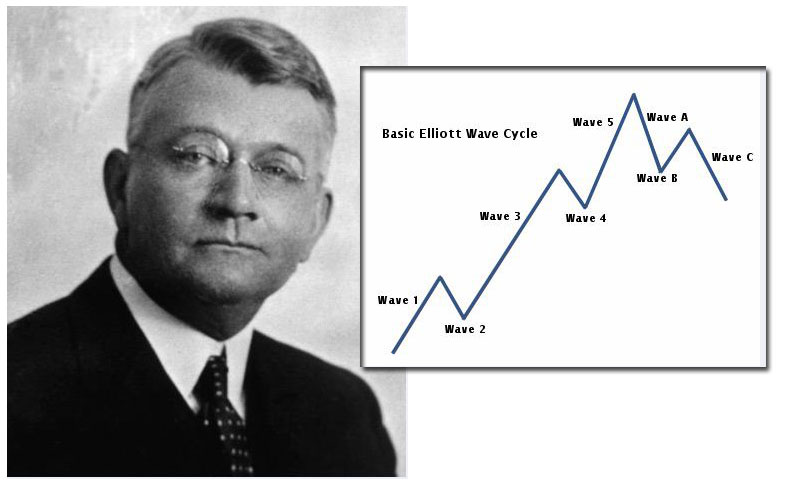

Elliott Wave Theory and Principle is composed of several critical ideas and parts. One of the more important of them is the concept of the fractal. Fractals make it easier to spot and count Elliott Waves.

What Are Fractals?

Elliott Wave Theory has a basic principle about the nature of the market. This is that its structure is fractal. This makes understanding fractals important to properly using Elliott Wave. Fractals can be understood in several ways. They are closely identified with both chaos theory and mathematics. Chaos refers to fractals as the market undergoing movements that are similar on every time frame. Fractals mean that market movements have order, though they often appear to be random at casual glance. Mathematics further expands the definition of fractals as patterns that are similar to each other. They are exactly the same or nearly the same to one another on every scale. Thanks to fractals, when Elliott Wave patterns appear on long term charts, they also appear on shorter term charts. The short term chart patterns may show some structures that are more complicated, but in general they will be smaller versions of the longer term chart patterns. This is what is meant in Elliott Wave Theory as waves within waves.

How Fractals Help Forecast Price

With Elliott Wave, fractals prove to be the building blocks for forecasting market price fluctuations. Ralph Elliott discovered fractals that were better and more useful than those of chaos and math theories. They came in a limited number of particular patterns. The Elliott Wave fractals came as five wave impulses that were finally followed up by three wave correction patterns. Because these fractals repeat on every scale with some variance, they are useful for predicting trends and future price movements of markets. This is what gives the Elliott Wave Principle its ability to forecast prices. Fractals are key to this because they are the ending and beginning marks in individual Elliott Waves.

Finding Elliott Waves with Counting Fractals

Dr. Bill Williams is the individual who came up with the expression Elliott Wave Fractal. In his book Trading Chaos he first outlined the idea of counting fractals. As Dr. Williams observed about these fractals and the Elliott Wave patterns, “whatever happens between fractals is an Elliott Wave.”

Counting fractals refers to studying the positions of bars in high low bar charts. By identifying these patterns, it becomes easier to identify where one wave ends and the next one begins. This makes it extremely helpful in properly figuring out and counting the waves in the Elliott Wave Principle.

Dr. Williams’ identifies two different types of fractals for the purposes of counting fractals. These are simple to understand and elegant concepts. The first is an up fractal and the second is a down fractal. Up fractals are those where the high in a (high low) bar is higher than both the two bars that precede it and the two which follow it. Lows of these bars are not important in deciding the progression of the up fractal. Only five bars are considered in this pattern.

In cases where there are two bars in a row that are both equally highs then you consider six bars. In this particular scenario, the fractal is still an up fractal if the two bars before the two highs and the two bars that follow the highs are lower. When this pattern occurs, the counting fractal is the bar with the first high. Down fractals are figured the same way, only in reverse. This means that a down fractal would be a lower bar that is both preceded by and followed by two bars with higher lows.

In Conclusion

Once you have established where the counting fractals are located, figuring where the wave begins and ends becomes easy. As Dr. Williams put it, the Elliott wave is everything in between the two up fractals or down fractals. Five bar chart formations are best to use for daily charts or longer time period charts. Counting the fractals can apply for shorter time frames as well. Charts that are intraday work better for counting fractals with 21 bars, 13 bars, or 9 bars in the formations. This makes the use of these fractals in counting the various Elliott Waves a true breakthrough in the theory. It helps to clear up the confusion on which pattern is a wave and which is not.

Counting fractals this way has been called the key to the Elliott Waves. These counting fractals are easy to spot and understand. This is because bars are either a fractal or not a fractal according to the simple definition we went through. There is no such a thing as a half fractal or a possible fractal in a chart pattern. Anyone who has ever attempted to count the Elliott waves using just a close only line chart can appreciate what a revolution this represents in the application of the Elliott Wave Principle waves.

- Using Counting Fractals to Find Elliott Waves - May 19, 2016

- The Grand Supercycle Controversy - May 19, 2016

- Robert Prechter’s Enduring Impact on Elliott Wave Theory - May 12, 2016

- Elliott Wave Gold Review - April 29, 2016

- Common Objections to Elliott Wave Theory - April 28, 2016

- What Are Elliott Wave Theory’s Waves Within Waves About? - March 8, 2016

- Review of the New Classic Among The Elliott Wave Theory Books, “The Elliott Wave Principle” - February 25, 2016

- Reviews of 2 Classic Elliott Wave Theory Books - February 25, 2016

- The Origins of Elliott Wave Theory and How it Was Discovered - February 13, 2016

- Elliott Wave Stock Market Review - February 5, 2016