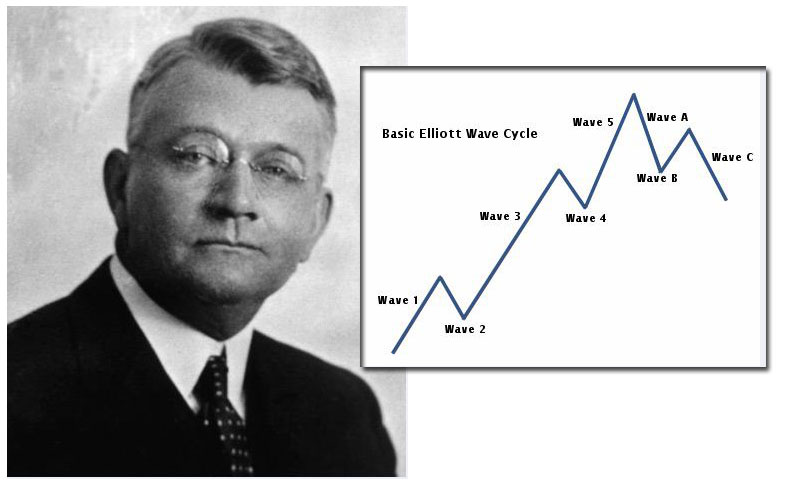

Most every devout follower of the Elliot Wave Theory and Principle is aware that the discoverer and creator of the Principle was the incomparable philosopher and intellectual market thinker Ralph Nelson Elliott. Yet even though he wrote two of the all time major classics on his self-named theory, he still died before he could fully flesh out his complex ideas. This magnum opus life work of Elliott’s was picked up and carried on successfully and logically by his disciple Robert Prechter. Because of this, it makes sense to read the authoritative work on Elliott Wave Theory by him, entitled Elliott Wave Principle, by Robert Prechter and A.J. Frost. In this post we consider the author in more detail and his own magnum opus on the subject of Ralph Nelson Elliott’s thought and what it has contributed to the body and knowledge of the Elliott Wave Theory in the intervening years.

About the Author Robert Prechter

Lead author Robert R. Prechter. Jr. has penned a few books on the stock market and other financial markets and is also the long-time editor of two differing monthly publications on forecasting markets entitled Global Market Perspective and The Elliott Wave Theorist. This Elliott Wave Theorist has been reviewed extensively by The Hulbert Rating Service. Their report came to the conclusion that this forecast of Robert Prechter’s beat the main performance of the competing stock market index the Wilshire 5000 on a 13 and 1/2 year comparison basis period that concluded on December 31, 1993 at the same time that its portfolio was only exposed to the consequential risk of the markets for only half of the time period under consideration.

The EWT has similarly been given the “Award of Excellence” by Hard Money Digest on two separate occasions, as well as the “Timer of the Year” designation by Timer Digest on two separate occasions, the only newsletters to do this. Besides this, Mr. Prechter has also personally set an all time record for the “United States Trading Championships” when he successfully returned over 444% in a professionally monitored and real-money options account over this four month time frame of the contest. Financial News Network awarded him title of “Guru of the Decade” in December of 1989. Robert Prechter has also served from 1990 to 1991 as President for the 21st consecutive year of the Market Technicians Association.

Review of Elliott Wave Principle by Robert Prechter and A.J. Frost

Sometimes affectionately referred to as the Blue Book of Elliott Wave, this Elliott Wave Principle by Robert Prechter and A.J. Frost certainly references much more current data and relevant statistics than Ralph Nelson Elliott’s insightful original. Critics have also stated that Prechter’s interpretation of the Theory is far more elegant, completed, and refined than the Ralph Nelson Elliott original master works. How is this at all possible, for the disciple, even the leading disciple in the field, to exceed the original teachings of the founding grand master?

The explanation most commonly given is that by the point that Ralph Nelson Elliott had fully and completely unravelled his own complicated theory and principle and ironed out the various “bugs,” he had already grown to be a very old man who then eventually died before he could write a third book to complete it all. In came Robert Prechter and his researching and writing team riding to the rescue later on to pick up the various elements of the still not fully completed Principle and Theory to finish it up and increase the refinement and elegance of it at the same time.

How Does Prechter’s Premise on Elliott Wave Theory Improve On And Clarify the Original Teachings?

You might think about the science of Elliott Wave with teacher and disciple who improved on the ideas like the teachings of Christianity as taught by Jesus but written down by others. Sure, Jesus is the one who created and propigated these ideas about the kingdom of heaven, but it was actually several of his original disciples like John, Peter, and Luke who took this body of thought and teachings and expounded on them, writing them down and refining their language and elegance in the process.

Where Elliott Wave’s heady original thought is concerned, the sad truth is that many people who pick up his original two works, The Wave Principle and Nature’s Law simply can not understand it; it is too high and far above their conceptual experience. Besides this, Elliott’s wave findings are actually about a great deal more than simply financial markets, as important as understanding the markets to make money may be. These basic fundamental building block ideas that underpin Elliott’s Wave Principle and the behaviors of not only the financial markets prove to be those identical forces that support and underlie the whole natural world and workings of the universe. This is where Robert Prechter comes onto the scene. He actually takes these heady but powerful ideas and distills them down to a more natural and understandable body of thought and writing which your average intelligence person can wrestle with and coherently grasp with a little effort and dedication.

Prechter’s genius appears in subtle yet important ways, such as when he periodically updated the body of work and market experiences with newer editions. In each of these later editions, he and A.J. Frost have further enhanced and refined the principle, while making sure to keep all of the predictions of the prior editions intact and inside. The most impressive such instance of this is the Twentieth Anniversary Edition. It came with an improved text and a special foreword. This has been called the final and ultimate revision of the timeless classic.

Final Assessment of Prechter and Frost’s Elliott Wave Principle

The final assessment of this epic work is that there are no people on the middle of the fence where it and its esteemed teachings are concerned. In truth, readers either love passionately the ideas and concept of it or they hate it with a passion. Those who love it can attest to the ways that it effectively and accurately answers a great number of important questions about human reactions, world history, mass social psychology, and the behavior of markets around the globe and across the spectrum. This book goes as far in reconstructing the tapestry of all human history as it does in outlining and predicting the movements of stocks and other financial markets.

In Conclusion – What the Book Is and Is Not

No book can be all things to all people all of the time, and this Elliott Wave Principle is no exception to the common rule. This is not a day-trading book or a primer on getting rich quick. It requires hours of work and thinking to get through it and to understand all of the Elliott Wave Theory’s complex moving parts. What the book is remains a guide to understanding the markets as a product of human nature. It also delivers an excellent and longer term perspective and understanding of the whole of human history. The book is also useful as a means of explaining numerous elements in the markets and economics ranging from minor and major corrections in the markets, to extended and drawn-out economic depressions, to massive world wars, and even to the darkest epoch in human history, the Middle Ages or so-called “Dark Ages.”

- Using Counting Fractals to Find Elliott Waves - May 19, 2016

- The Grand Supercycle Controversy - May 19, 2016

- Robert Prechter’s Enduring Impact on Elliott Wave Theory - May 12, 2016

- Elliott Wave Gold Review - April 29, 2016

- Common Objections to Elliott Wave Theory - April 28, 2016

- What Are Elliott Wave Theory’s Waves Within Waves About? - March 8, 2016

- Review of the New Classic Among The Elliott Wave Theory Books, “The Elliott Wave Principle” - February 25, 2016

- Reviews of 2 Classic Elliott Wave Theory Books - February 25, 2016

- The Origins of Elliott Wave Theory and How it Was Discovered - February 13, 2016

- Elliott Wave Stock Market Review - February 5, 2016