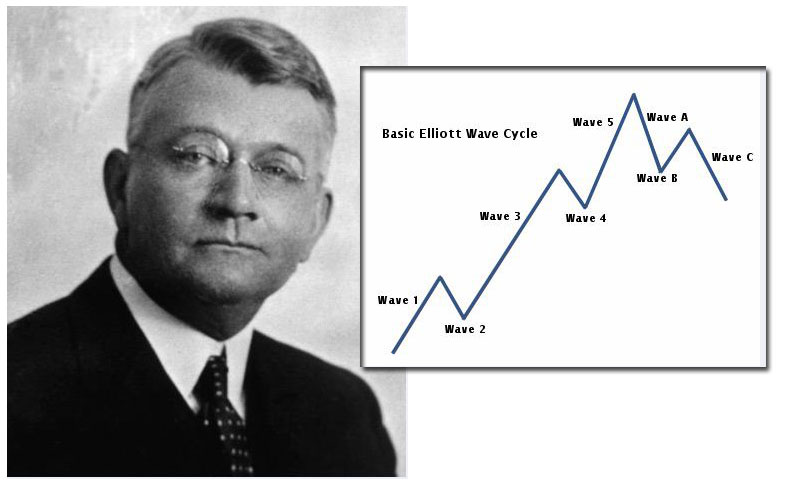

When Ralph Elliott came up with his self-titled Elliott Wave Theory, he found there were nine different degrees in the waves. These waves could span from centuries down to even minutes. He labelled these waves:

• Grand Supercycle – multi -centuries long • Supercycle – multiple decades in length (often from 40 – 70 years)

• Cycle – from one to several years long

• Primary – from several months to several years

• Intermediate – from a few weeks to several months

• Minor – weeks in length

• Minute – days long

• Minuette – several hours

• Subminuette – minutes long

The one wave that attempts to explain large timeframes of human economic and stock market history is the Grand Supercycle. Though it covers a great amount of ground, it is not without controversy.

The Multiple Centuries of the Grand Supercycle

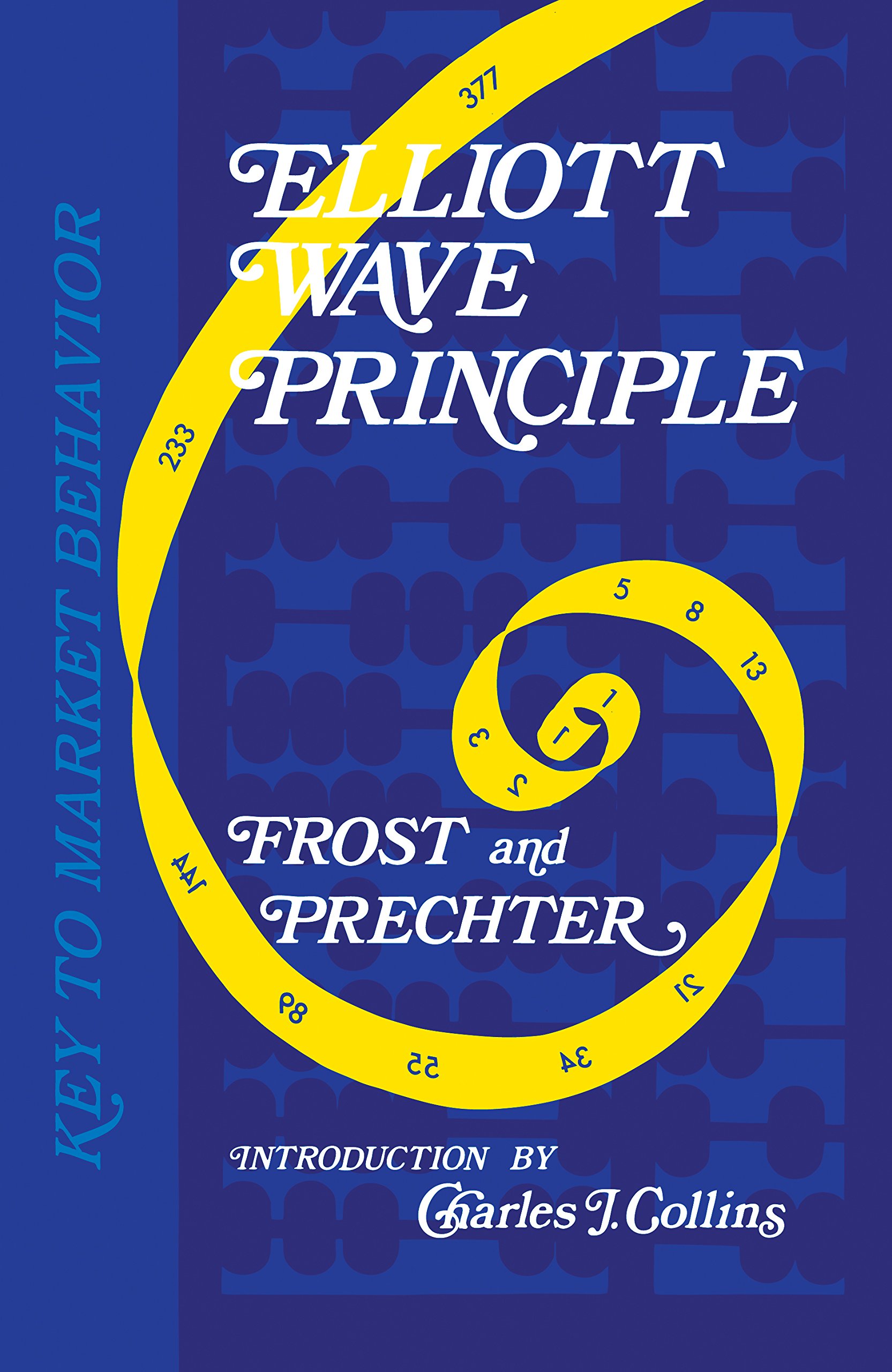

The biggest of the waves in Ralph Elliott’s universe is this Grand Supercycle. This wave cycle covers hundreds of years in time. To give you an idea of this, one of the grand supercycles began in the Middle Ages. The ones that are most pertinent for U.S. investors concern the grand supercycle that Elliott claimed began with U.S. stock markets back in 1857 and ran on up to 1928 before the Great Depression began. At the time, Elliott admitted that he lacked long enough sets of data to be sure this time period was a complete Grand Supercycle. He suggested that it might instead be a third or fifth wave in the entire Grand Supercycle itself. This idea was later clarified and reformulated by Elliott’s disciple Robert Prechter who had access to longer sets of historical financial data. Prechter and Frost in their book The Elliott Wave Principle concluded that the American Grand Supercycle began in 1789. This is the point when data on the U.S. stock markets originated.

Controversies Surrounding the Grand SuperCycle Wave

Just as there are common objections to Elliott Wave ideas, this grand supercycle theory has more than its share of controversy. Robert Prechter and others have surmised that this American Grand SuperCycle will end its Wave 5 sometime in this 21st century. The controversies begin with what will happen afterward. Prechter and the proponents of this theory believe that when this wave completes, there will be a massive declining correcting price pattern. They state that this price pattern will prove to be the greatest economic depression the world has seen from the 1700s on to today. Naturally this is not a popular outlook or prognosis among present day economists.

• A second controversy has to do with the the amount of time that is involved with a grand supercycle. Ralph Elliott’s theories are based on the idea that human behavior and response is predictable. When the time being considered is greater than a single human lifetime, it becomes more difficult to hold with the idea that the same predictable reactions from one generation to the next will continue. Some critics of the grand supercycle go so far as to say that it simply can not exist since it encompasses a number of human lives. One of these groups are the believers in Saeculum Theory. They insist that certain generations must learn again the lessons of their ancestors. This objection which has been borne out by history would present problems for the grand supercycle waves.

• Another controversy that argues against a coming bear market brought on by the end of a grand supercycle has to do with society’s ability to learn from the past. In order for this bear market to repeat itself, humanity must be incapable of learning the lessons of its prior mistakes. Some authors such as David Fischer who wrote The Great Wave have convincingly argued that humanity’s crises are gradually decreasing in volatility. This makes the case that as a whole mankind is learning from the past on at least some level.

• Other arguments against the grand supercycle notion suggest that the price data for stock transactions going back to the early years of the U.S. is sketchy at best. In order for Ralph Elliott to make the case that such a grand supercycle began then, he had to string together the prices of gold, British stock market historical levels, and then American stock market historical levels. Some have called this scientific methodology into question.

• Finally, there is the argument about the lack of economic and scientific understanding. There may be social cycles that exist over centuries of time. Critics argue that the ability to understand and explain what might cause them is not well enough developed.

In Conclusion

Many of Elliott Wave’s nine cycles have proven themselves to be invaluable in explaining stock market behavior. The grand supercycle is one where the evidence is not clear enough to make a conclusive determination. This does not mean that you should not be prepared for the possibility of the American Grand Supercycle bear market that Robert Prechter has predicted. It is always a good idea to have a plan for a severe economic downturn.

- Using Counting Fractals to Find Elliott Waves - May 19, 2016

- The Grand Supercycle Controversy - May 19, 2016

- Robert Prechter’s Enduring Impact on Elliott Wave Theory - May 12, 2016

- Elliott Wave Gold Review - April 29, 2016

- Common Objections to Elliott Wave Theory - April 28, 2016

- What Are Elliott Wave Theory’s Waves Within Waves About? - March 8, 2016

- Review of the New Classic Among The Elliott Wave Theory Books, “The Elliott Wave Principle” - February 25, 2016

- Reviews of 2 Classic Elliott Wave Theory Books - February 25, 2016

- The Origins of Elliott Wave Theory and How it Was Discovered - February 13, 2016

- Elliott Wave Stock Market Review - February 5, 2016